This week, a host of representatives from the automotive ecosystem visit imec to discuss chiplets and how to jointly tackle their challenges. More news about this initiative will follow. But why are chiplets such a hot topic in the automotive industry? Here are four key reasons.

1. It’s a question of ‘horsepower’: soon, every car will need a supercomputer on board

To say that cars are turning into ‘computers on wheels’ is already a bit of a cliché. It’s also quickly becoming an understatement. Standard compute power inside the electronic control unit (ECU) will not be able to process the enormous workloads that come with the ADAS, communication, and entertainment functions of tomorrow’s vehicles. Only high-performance compute can rise to that challenge.

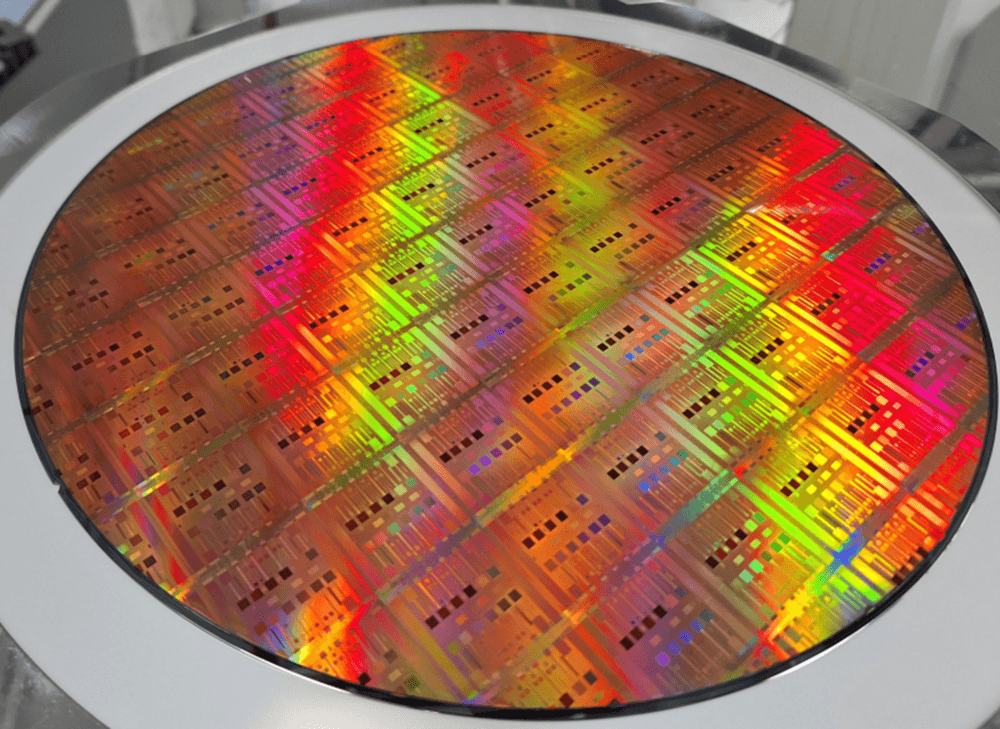

Such supercomputing can no longer be achieved in one package using monolithic IC design – as the size and complexity would become unmanageable. Chiplet design – a modular approach based on heterogeneous integration – allows to scale up the number of transistors and other components without hitting the physical limits of a single chip. It’s being implemented in all kinds of supercomputing applications, and cars cannot afford to trail behind.

“Standard compute power inside the ECU will not be able to process the workloads that come with the ADAS, communication, and entertainment functions of tomorrow’s vehicles.”

2. An exponential performance increase must not lead to an explosion of cost

Does driving a supercomputer sound like an expensive idea to you? Then the good news is that using chiplets leads to a reduction of cost. That’s because:

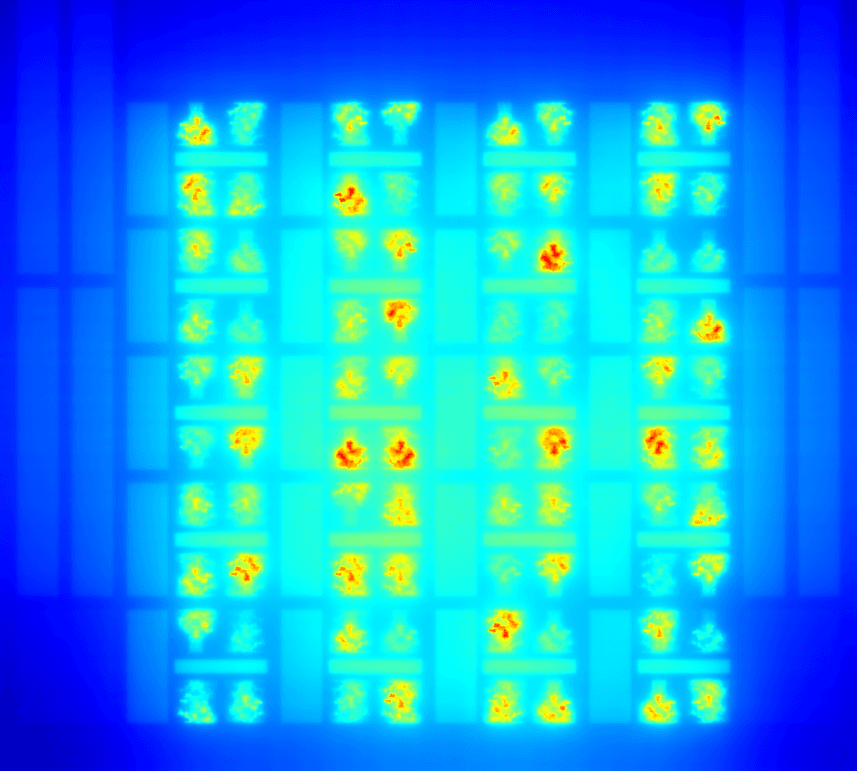

- Different processes can be used for different chiplets, because not all functions need the most advanced (and expensive) semiconductor technology nodes.

- The opportunity to use optimized processes for specific tasks, combined with the sharing of resources such as wiring and cooling infrastructure leads to overall energy savings.

- Chiplets are less complex to manufacture than large monolithic chips. That leads to fewer defects, thus higher yields.

The lower production costs are partly offset by higher packaging costs. Nevertheless, the savings realized by using chiplets vs. monolithic design is estimated to be 40%.

Imec's automotive chiplet program looks into accelerating and derisking chiplet adoption through reference architectures and physical testbeds.

3. Digital innovation becomes a key differentiator for car companies, if they can move fast enough

Automotive OEMs that want to distinguish themselves from their competitors have plenty of options: more safety features, extraordinary entertainment options, a fluid communication interface, ... But no matter the choices they make, they most likely involve changes to the soft- and/or hardware. And they need to be implemented quickly to keep the time to market as short as possible.

While upgrading a monolithic design is a long process, replacing or adding a chiplet should be as simple as swapping a yellow LEGO block for a blue one. It can happen during the lifetime of a vehicle line. This gives OEMs the opportunity to build a dependable yet flexible electronic architecture with a base function chiplet augmented by workload-specific chiplets in the same package. And that brings us to the final point ...

“Replacing or adding a chiplet should be as simple as swapping a yellow LEGO block for a blue one.”

4. Automotive OEMs need to control their own destiny, starting with their IC supply chain

Ever since COVID, a stable semiconductor supply chain has been a top priority within the automotive sector. And while the lockdowns have passed, there’s still reason for concern. For chip suppliers, automotive is a challenging market (with stringent reliability requirements) that takes relatively low volumes. And development costs in advanced nodes are increasing exponentially. For these reasons, there’s a dwindling number of automotive processor vendors. And they have to stick to a one-size-fits-all solution across multiple market segments to reach sufficient volume per design.

When the number of suppliers is down to three or even less, the supply chain becomes vulnerable. The move to chiplet-based processors, that are less taxing to develop, could lead to the rise of new (niche) players that make the market more diverse and resilient. It could even allow OEMs to make their own chiplets.

Of course, for this mix-and-match strategy to work, there’s a need for standardization across the industry when it comes to packaging and interconnects. With the automotive chiplet working group that kicks off this week, imec brings together the major industry players to identify and tackle the most pressing challenges.

Are you active in the automotive industry and do you want to discuss your semiconductor challenges? Check out the website of star, the imec-launched global network that unites experts from the automotive and semiconductor industries. Or click the button below to get in touch.

More about these topics:

Published on:

20 June 2023